Whether you’re a financial advisor, investment issuer, or other financial Expert, explore how SDIRAs may become a powerful asset to grow your small business and attain your Specialist targets.

Increased Service fees: SDIRAs generally come with greater administrative expenditures when compared with other IRAs, as certain aspects of the executive approach cannot be automatic.

Entrust can assist you in obtaining alternative investments with the retirement funds, and administer the purchasing and offering of assets that are typically unavailable through banking companies and brokerage firms.

Research: It truly is termed "self-directed" to get a cause. By having an SDIRA, that you are entirely accountable for extensively investigating and vetting investments.

Criminals occasionally prey on SDIRA holders; encouraging them to open accounts for the goal of earning fraudulent investments. They normally idiot traders by telling them that In the event the investment is acknowledged by a self-directed IRA custodian, it should be reputable, which isn’t true. All over again, You should definitely do extensive research on all investments you decide on.

Restricted Liquidity: Lots of the alternative assets which can be held within an SDIRA, which include property, personal fairness, or precious metals, might not be effortlessly liquidated. This may be a concern if you'll want to accessibility cash speedily.

Adding cash on to your account. Keep in mind that contributions are topic to once-a-year IRA contribution restrictions set via the IRS.

Many investors are shocked to learn that working with retirement cash to speculate in alternative assets has become probable considering that 1974. Having said that, most brokerage firms and banks focus on offering publicly traded securities, like stocks and bonds, mainly because they deficiency the infrastructure and abilities to manage privately held assets, which include housing or personal equity.

Range of Investment Solutions: Ensure the service provider lets the categories of alternative investments you’re keen on, including real estate, precious metals, or private equity.

And since some SDIRAs for example self-directed conventional IRAs are subject matter to needed bare minimum distributions (RMDs), you’ll need to system ahead to ensure that you might have adequate liquidity to fulfill The foundations established because of the IRS.

Earning the most of tax-advantaged accounts lets you retain far more of The cash that you choose to invest and get paid. Based on whether you choose a traditional self-directed IRA or perhaps a self-directed Roth IRA, you might have the possible for tax-free of charge or tax-deferred growth, furnished specified problems are met.

Consider your Mate may be you can find out more beginning the next Fb or Uber? Using an SDIRA, you'll be able to invest in triggers that you believe in; and potentially love better returns.

Greater investment alternatives indicates you'll be able to diversify your portfolio over and above shares, bonds, and mutual money and hedge your portfolio towards current market fluctuations and volatility.

As soon as you’ve located an SDIRA supplier and opened your account, you could be wondering how to truly start investing. Being familiar with the two the rules that govern SDIRAs, in addition to tips on how to fund your account, might help to put the muse for your way forward for prosperous investing.

The key SDIRA regulations from the IRS that traders will need to understand are investment restrictions, disqualified individuals, and prohibited transactions. Account holders will have to abide by SDIRA policies and polices in order to preserve the tax-advantaged standing of their account.

Complexity and Obligation: Having an SDIRA, you have got far more Handle above your investments, but Additionally you bear more responsibility.

Unlike shares and bonds, alternative assets in many cases are harder to promote or can have rigid contracts and schedules.

This features being familiar with IRS rules, handling investments, and staying away from prohibited transactions that could disqualify your IRA. An absence of information could lead to costly problems.

From time to time, the charges affiliated with SDIRAs might be higher and much more sophisticated than with a regular IRA. It is because of your amplified complexity related to administering the account.

Haley Joel Osment Then & Now!

Haley Joel Osment Then & Now! Neve Campbell Then & Now!

Neve Campbell Then & Now! Robert Downey Jr. Then & Now!

Robert Downey Jr. Then & Now! David Faustino Then & Now!

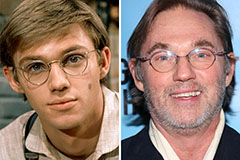

David Faustino Then & Now! Richard Thomas Then & Now!

Richard Thomas Then & Now!